The Importance of Pet Insurance:

Pets are not just animals; they are family. From wagging tails to purring cuddles, they bring immense joy and companionship into our lives. But just like humans, pets can suffer from unexpected illnesses and accidents, leading to hefty veterinary bills. That’s where pet insurance becomes a game-changer.

Pet insurance helps cover the cost of emergency medical care, chronic conditions, preventive treatments, and even alternative therapies, ensuring your furry friend receives the best care possible without breaking the bank.

Health is the greatest wealth."

Ralph Waldo Emerson

Why choose Arcov Architecture

Why Pet Insurance Is a Must-Have for Pet Owners

1. Rising Vet Costs and Unexpected Emergencies

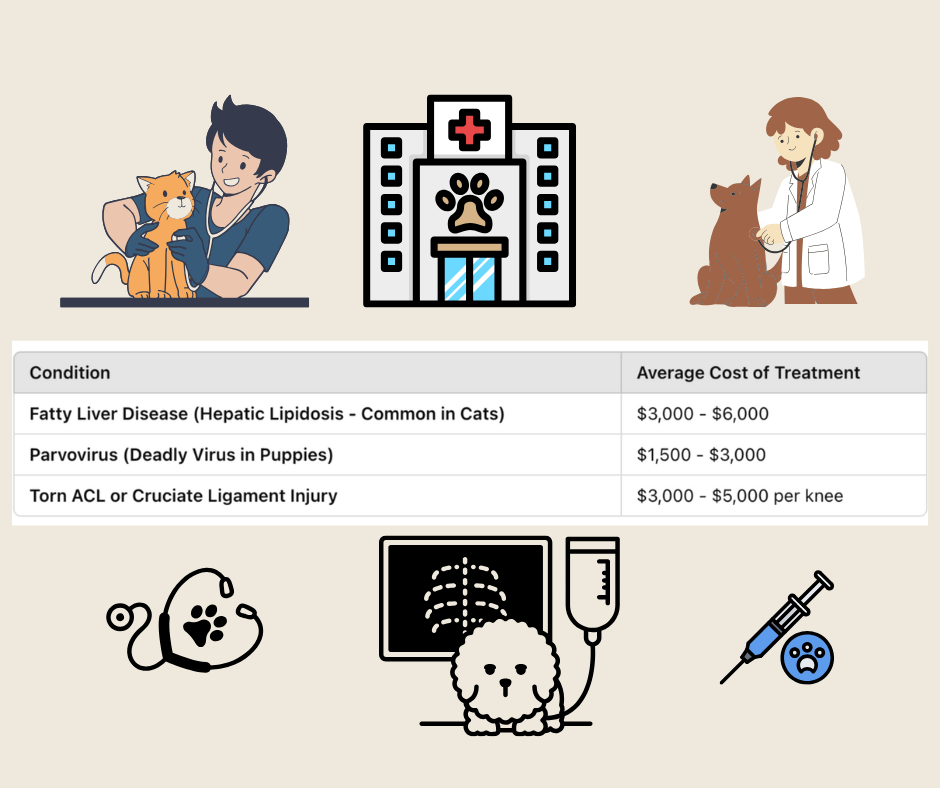

Veterinary care is becoming more expensive due to advancements in medical treatments, diagnostic tools, and pharmaceuticals. A single emergency vet visit can cost anywhere from $1,000 to $5,000, depending on the condition.

Without insurance, pet owners may face difficult financial choices, potentially delaying treatment or even considering euthanasia due to unaffordable medical bills.

2. Coverage for Preventative Care to Keep Pets Healthy

Many insurance plans now offer wellness add-ons that cover routine vet visits, vaccinations, flea & tick prevention, dental cleanings, and even spaying/neutering. By investing in preventative care, pet owners can prevent costly diseases before they become serious

- Leading Pet Insurance Companies:

- Healthy Paws Pet Insurance

- Trupanion

- ASPCA Pet Insurance

- Embrace

- Figo

- Pets Best

- Nationwide Pet Insurance

Choosing the right pet insurance provider is crucial. Here are the top 7 pet insurance companies, based on customer satisfaction, affordability, and coverage options:

3. Protecting Against Expensive Treatment

How Pet Owners Benefit from Pet Insurance

1. Reduces Financial Stress

Pet insurance ensures that unexpected vet bills don’t drain your savings. Instead of worrying about money, you can focus on getting your pet the best possible care.

2. Gives Access to Advanced Treatments

Many pet owners can now afford life-saving surgeries, chemotherapy, rehabilitation, and alternative therapies (like acupuncture and hydrotherapy) thanks to pet insurance coverage.

3. Helps You Budget for Routine Care

Some plans offer preventative care coverage, allowing pet owners to spread out the cost of vaccines, exams, and medications instead of paying lump sums.

4. Encourages Early Diagnosis & Treatment

Since insurance reduces the cost burden, pet owners are more likely to take their pets for regular check-ups, leading to early detection of diseases.

Preventative Services Covered by Pet Insurance

Many pet insurance providers now offer wellness plans that cover:

✔ Annual vet exams (Average cost: $50 – $100)

✔ Vaccinations (Rabies, Distemper, Bordetella, etc.)

✔ Flea, tick & heartworm prevention

✔ Routine bloodwork & diagnostic tests

✔ Spay/neuter surgeries

✔ Dental cleanings (Average cost: $300 – $700 without insurance)

Taking advantage of preventative care can help pets live longer, healthier lives while also reducing future medical costs.

How to Maximize Pet Insurance Benefits

Pet owners should follow these steps to get the most value from their insurance plan:

✅ Sign up early – The younger your pet, the lower the premium & fewer pre-existing condition exclusions.

✅ Choose a customizable plan – Ensure your policy covers hereditary conditions common in your pet’s breed.

✅ Use wellness add-ons – Preventative care coverage helps reduce the risk of expensive treatments later.

✅ Understand your deductible & reimbursement rates – Find a balance between monthly premiums & out-of-pocket costs.

✅ Submit claims ASAP – Many providers offer app-based instant reimbursements (e.g., Figo, Trupanion).

Final Thoughts: Is Pet Insurance Worth It?

Absolutely! The cost of pet insurance far outweighs the risk of facing thousands in unexpected vet bills. For a small monthly fee, pet owners gain peace of mind knowing they can provide top-quality care for their furry companions.

Key Takeaways:

✔ Vet bills can cost thousands of dollars – Insurance helps cover those expenses.

✔ Pet insurance protects against emergencies like parvovirus, fatty liver disease, and ACL tears.

✔ Wellness coverage helps prevent diseases before they start.

✔ Choosing the right provider depends on your pet’s needs & budget.

By investing in pet insurance today, you ensure a healthier, happier life for your pet without the financial stress. 🐶🐱💙

Have you considered pet insurance for your furry friend?

.